Founders lose time in fundraising when term sheets are reviewed without a defined process. Clauses affecting ownership, control, and future rounds require clear modeling and benchmarks. Without this, decisions slow down and revisions accumulate.

The AI-powered Term Sheet Analyzer uses contextual intelligence to convert any uploaded term sheet into a complete assessment with quantified impact, benchmarks, and specific negotiation actions.

How term sheets affect founders

Even though term sheets follow predictable patterns, most founders still struggle because:

Dilution and ownership changes are not visible across scenarios

Clauses are complex and include implications that are easy to miss

It is difficult to understand existing risks, opportunities, and blockers

These gaps extend negotiation timelines and increase uncertainty about the impact of each term.

What a structured review actually solves

The Analyzer turns any PDF or Doc term sheet into a clear, benchmarked, and fully modeled breakdown.

You get:

Your Founder Health Score

Immediate risk alerts

Clauses translated into plain English

Market benchmarks for similar-stage companies

SAFE and term modeling with real inputs

A checklist of what to negotiate next

An AI assistant that answers document-specific questions in seconds

This gives you a single, consistent workflow instead of 10 scattered conversations.

Inside the OS

The Term Sheet Analyzer operates through four steps designed to keep the process clear and sequential.

1. Upload and System Assessment

Upload your PDF. The system extracts clauses using contextual intelligence and generates:

Founder Health Score

Risk Alerts

Negotiation Opportunities

Estimated Time to Close

This establishes the baseline for the remainder of the review.

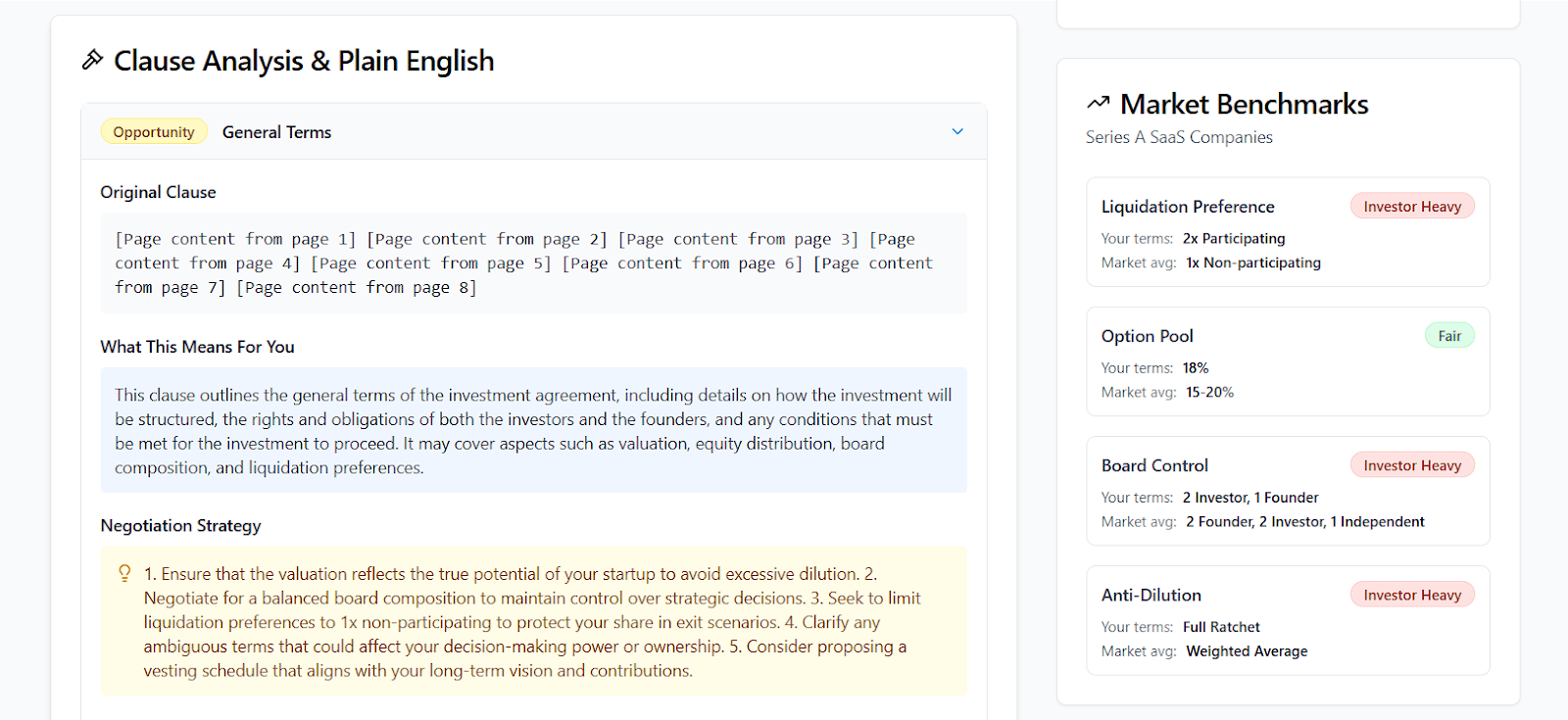

2. Clause Review and Benchmarks

Each clause is translated into its operational impact. The system evaluates liquidation preference, anti-dilution, vesting acceleration, board rights, and drag-along provisions.

Benchmarks show how your terms compare to similar-stage companies, giving immediate context for negotiation.

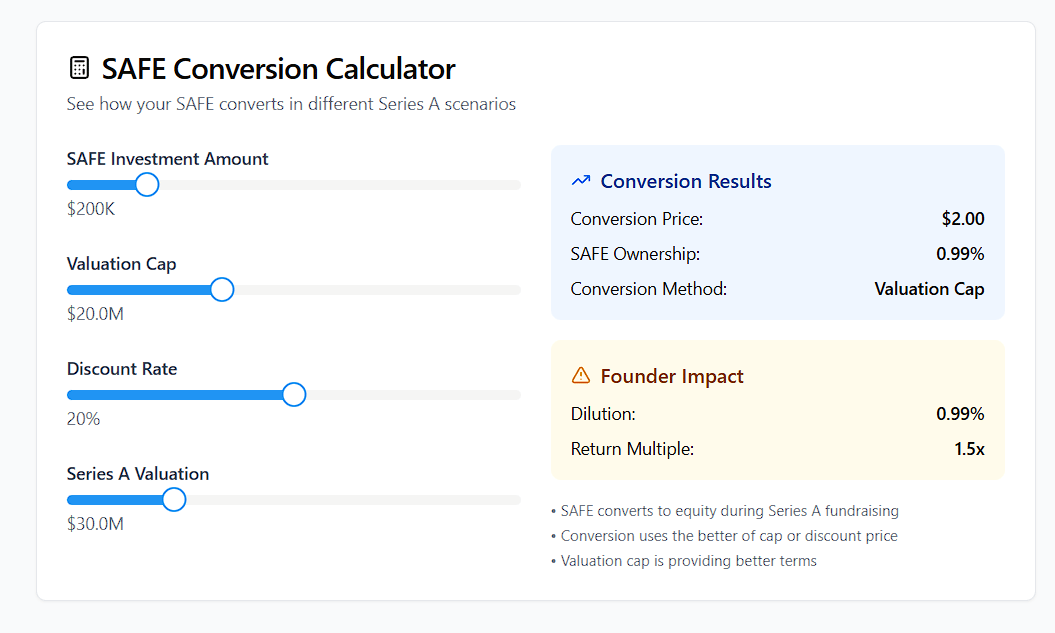

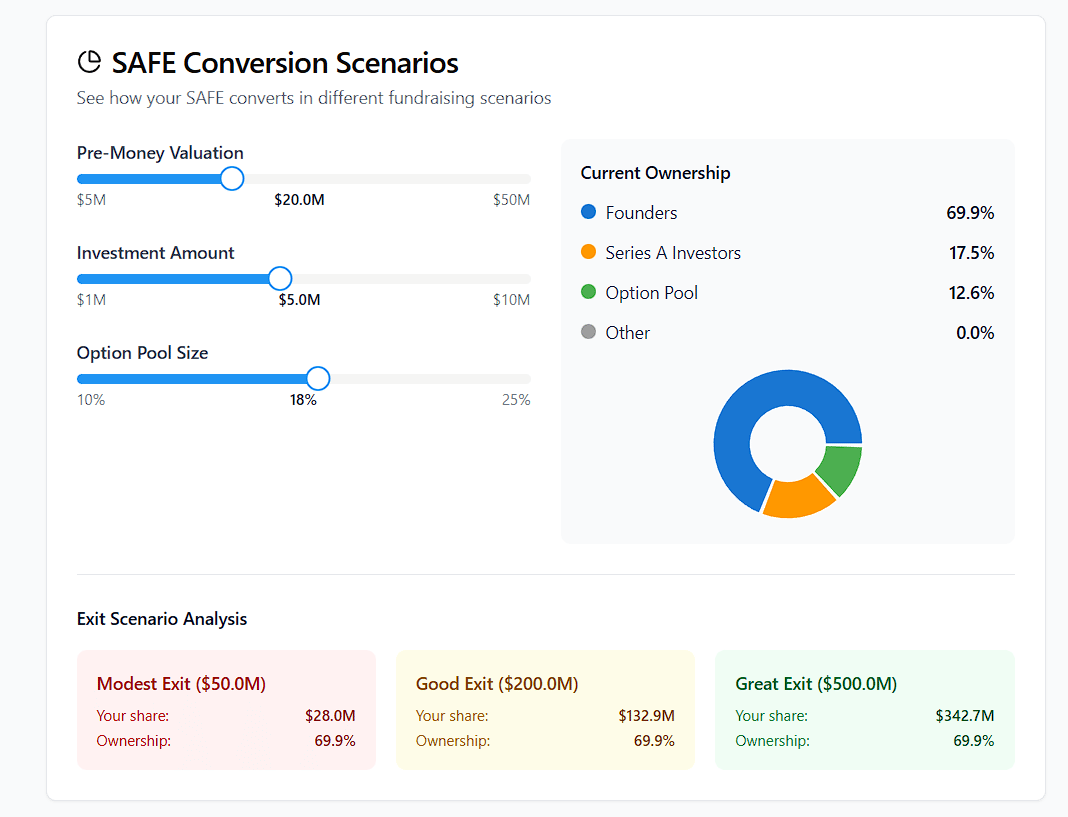

3. Scenario Modeling

The SAFE conversion calculator models conversion price, ownership, dilution, and return multiples. Inputs such as valuation cap, discount rate, and Series A valuation can be modified to assess different outcomes with precision.

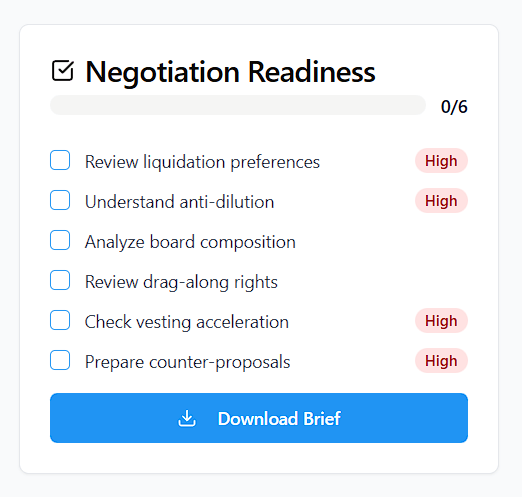

4. Negotiation Readiness

A structured checklist highlights what requires action before negotiation. This includes dilution analysis, governance review, vesting terms, and preparation of counter-proposals.

Each item is prioritized based on your document.

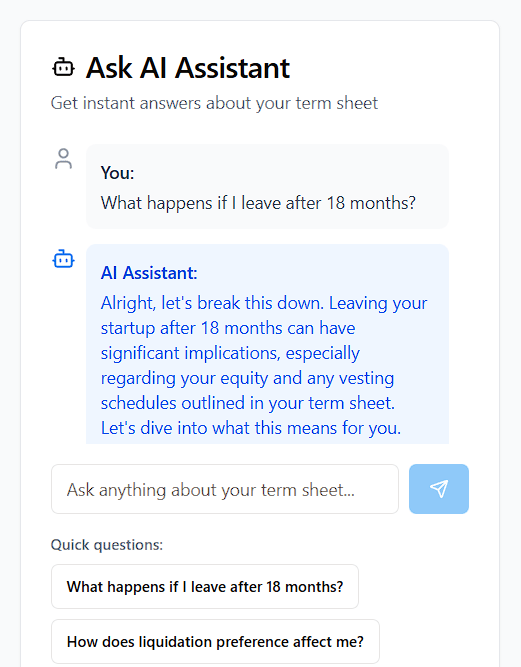

5. Ask the AI Assistant

Founders can also use the AI-powered assistant to get direct answers to specific questions. The system interprets scenarios such as leaving the company after 18 months, how liquidation preference affects outcomes, or what ownership looks like after a Series B.

It also evaluates governance and negotiation questions, including whether board control can be adjusted. This removes uncertainty by providing immediate, document-specific explanations without relying on external sources.

What structured review enables

A modeled, benchmarked, and AI-powered interpretation of your term sheet reduces ambiguity and shortens negotiation cycles. Founders receive a clear summary of risks, opportunities, conversion outcomes, and next steps without fragmented review work.

The Term Sheet Analyzer is one component of the Venture OS. Each tool transforms manual tasks into structured workflows supported by contextual intelligence.

Join the waitlist for early access.